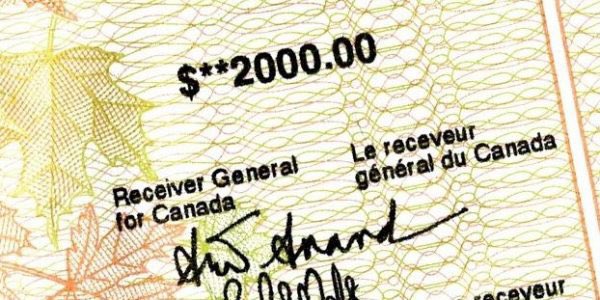

The letters have gone out and if you received the Canada Emergency Response Benefit and CRA thinks you shouldn’t have, uh oh.

Here are the rules in case you have received the letter or think that it might be in the post:

Gross Employment Income (including NET self-employment income) must have been at least $5,000 in 2019. Employment income also includes Provincial and Federal maternity and parental benefits.

Gross or self-employment Income does not include:

- Pension income of any kind including RRSP withdrawal and RIF's;

- Disability or social assistance benefits including the child benefit or working income tax benefit or federal supplements;

- Family support payments;

- Worker’s Comp or E.I.;

and

- Investment income

If you need to return your CERB payments, at the time of this writing, the CRA is not issuing fines or penalties if the money is returned by December 31, 2020.

Recent Comments